More About Pacific Prime

Insurance coverage also assists cover expenses connected with responsibility (lawful duty) for damages or injury triggered to a third party. Insurance is an agreement (policy) in which an insurance provider compensates one more versus losses from particular backups or risks.

Investopedia/ Daniel Fishel Many insurance coverage kinds are available, and practically any private or service can discover an insurance provider happy to insure themfor a cost. Common personal insurance plan kinds are car, health and wellness, homeowners, and life insurance policy. A lot of individuals in the USA have at least among these sorts of insurance coverage, and vehicle insurance coverage is required by state regulation.

Unknown Facts About Pacific Prime

So locating the cost that is best for you requires some legwork. The plan limitation is the optimum amount an insurance firm will spend for a covered loss under a policy. Maximums may be established per period (e.g., annual or plan term), per loss or injury, or over the life of the plan, likewise called the lifetime optimum.

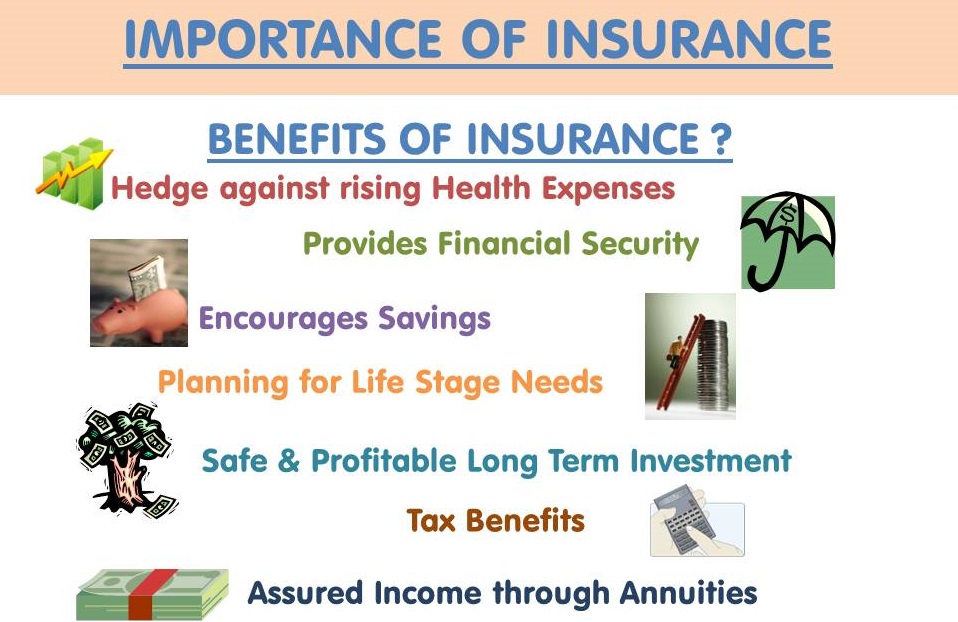

There are lots of various types of insurance policy. Health insurance assists covers routine and emergency clinical treatment expenses, often with the option to include vision and dental solutions separately.

Nevertheless, several preventative solutions might be covered for complimentary prior to these are fulfilled. Medical insurance may be purchased from an insurer, an insurance policy representative, the federal Wellness Insurance Industry, provided by a company, or government Medicare and Medicaid protection. The federal government no longer needs Americans to have medical insurance, however in some states, such as The golden state, you may pay a tax fine if you don't have insurance.

Little Known Questions About Pacific Prime.

Rather than paying out of pocket for car accidents and damages, people pay yearly premiums to an automobile insurance provider. The business after that pays all or the majority of the covered expenses related to a vehicle crash or other automobile damages. If you have a rented lorry or obtained cash to buy a car, your lending institution or renting car dealership will likely require you to bring car insurance coverage.

A life insurance coverage plan guarantees that the insurance firm pays a sum of cash to your beneficiaries (such as a partner or kids) if you die. There are two main types of life insurance.

Insurance policy is a means to manage your economic threats. When you buy insurance coverage, you acquire protection against unforeseen monetary losses. The insurance provider pays you or a person you select if something negative takes place. If you have no insurance coverage and an accident happens, you might be responsible for all relevant expenses.

The Facts About Pacific Prime Revealed

Although there are many insurance plan types, some of the most typical are life, wellness, house owners, and auto. The appropriate kind of insurance coverage for you will depend on your goals and economic circumstance.

Have you ever had a moment while looking at your insurance coverage policy or shopping read more for insurance coverage when you've assumed, "What is insurance coverage? Insurance coverage can be a mysterious and puzzling thing. Exactly how does insurance coverage work?

Suffering a loss without insurance can place you in a challenging economic scenario. Insurance coverage is a crucial financial tool.

Things about Pacific Prime

And in some situations, like automobile insurance and workers' payment, you may be needed by law to have insurance policy in order to shield others - expat insurance. Discover about ourInsurance choices Insurance is essentially a massive nest egg shared by lots of people (called insurance policy holders) and managed by an insurance coverage service provider. The insurance business utilizes money gathered (called costs) from its policyholders and other financial investments to pay for its procedures and to accomplish its assurance to policyholders when they submit a case

:max_bytes(150000):strip_icc()/terms_i_insurance_FINAL_-3556393b3bbf483e9bc8ad9b707641e4.jpg)